Hiring employees is a pivotal step for small businesses, transforming them from individual endeavors into collaborative enterprises. This transition, while exciting, introduces a range of legal obligations that must be carefully managed. Understanding these responsibilities is crucial to ensure a compliant and efficient hiring process. By addressing key legal areas, small businesses can lay a solid foundation for growth and stability, fostering an environment where both the business and its employees can thrive.

Streamlining Employee Payroll Preparation

When you’re ready to compensate your employees, setting up a structured payroll system is crucial. Start by gathering essential tax identification numbers, such as the Employer Identification Number (EIN) and employees’ Tax Identification Numbers (TIN). This ensures accurate tax deductions and filings. Establish a consistent payroll schedule and calculate gross pay, accounting for necessary deductions like income tax and healthcare. To simplify these tasks, consider using an all-in-one business platform like ZenBusiness that offers integrated tools for financial management and tax advice.

Understanding State-Specific Worker Classification Laws

Understanding worker classification laws is vital, as they can vary significantly between states and federal regulations. For example, while the federal government might use a specific test under the Fair Labor Standards Act, states like California apply the more stringent ABC test. This means a worker classified as an independent contractor federally might be considered an employee under state law, affecting tax withholding and benefits eligibility. Staying informed about both federal and state regulations is essential to ensure compliance and avoid any potential legal issues.

Managing Workplace Grievances: A Guide for Small Businesses

Establishing a structured grievance process is key to managing workplace disputes effectively. Implement a clear, step-by-step procedure to address issues like pay disputes, discrimination, and workload concerns before they escalate. Start with an informal meeting, followed by a documented supervisor meeting if necessary, and escalate to higher management only if unresolved. This approach minimizes workplace disruption and ensures both employees and employers retain their rights to arbitration if needed. Proactively managing grievances fosters a harmonious work environment and demonstrates your commitment to fair practices.

Health and Retirement Compliance for Small Businesses

Adhering to state and federal regulations concerning health insurance and retirement plans is crucial when hiring employees. These regulations ensure employees receive fair benefits, including health coverage under the Affordable Care Act and retirement savings options like 401(k) plans. Compliance protects your employees and shields your business from potential legal penalties. For instance, failing to comply with the Children’s Health Insurance Program Reauthorization Act (CHIPRA) could result in financial repercussions.

Ensuring Employee Safety with Proper PPE Provision

Providing necessary personal protective equipment (PPE) is crucial for safeguarding employee health and safety. This includes items like gowns, face shields, masks, goggles, shoe covers, and gloves, essential in hazardous environments. Train your staff on how to properly inspect, wear, clean, and store PPE, as improper use can compromise protection. Regularly inspect and maintain PPE according to manufacturer guidelines, replacing any damaged equipment to maintain optimal protection. Implementing strict PPE policies and monitoring compliance creates a safer work environment and reduces injury risks.

Monitoring Equal Opportunity Complaints

Establishing a robust system for monitoring and addressing equal opportunity complaints is crucial for maintaining a fair workplace. Set up clear procedures for employees to report discrimination or unfair treatment, ensuring these processes are accessible and confidential. This not only complies with legal obligations under laws like the Equal Pay Act and the ADA but also fosters a culture of inclusivity and respect. Regularly reviewing and updating these systems with legal experts and industry partners can help identify systemic issues and prevent future occurrences. This proactive approach protects your business from potential lawsuits and enhances employee satisfaction and retention.

Safeguarding Your Innovations: The Crucial Role of NDAs

Protecting your innovative ideas and intellectual property is paramount, and Non-Disclosure Agreements (NDAs) play a pivotal role. NDAs are legally binding contracts that ensure sensitive information, such as trade secrets and strategic plans, remains confidential. By clearly defining what constitutes confidential information and outlining the obligations of the receiving party, NDAs help build trust and foster collaboration with partners, employees, and contractors. However, merely signing an NDA is not foolproof; additional measures may be necessary to fully safeguard your intellectual property.

Adopting essential legal practices when hiring employees helps establish a well-organized and positive work environment. Careful attention to these areas lets businesses operate smoothly, fostering both trust and stability within the team. Clear guidelines in employment practices reduce misunderstandings, creating a foundation for professional growth. Ensuring compliance also minimizes potential conflicts.

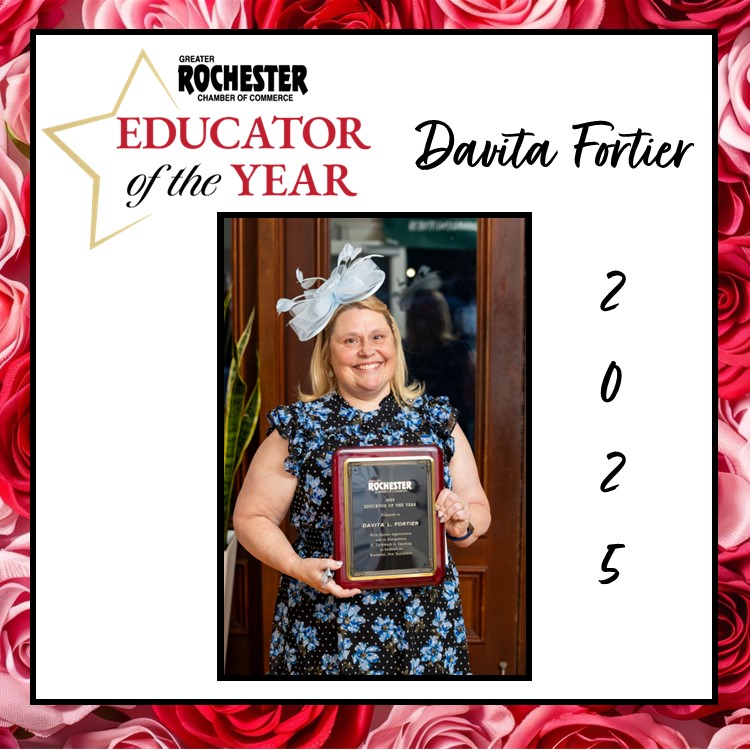

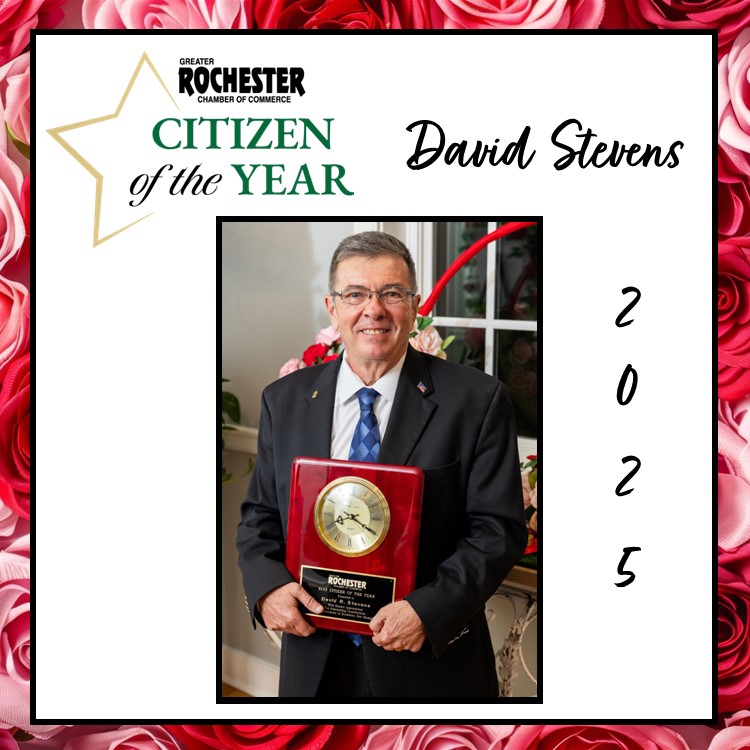

Discover the benefits of joining the Greater Rochester Chamber of Commerce and connect with a vibrant network of businesses dedicated to fostering a thriving community!